The real purpose of programmatic advertisement can always state two points; right impressions by the right audience. Pre-bid and Google Open Bidding offer these functions – but what makes them different from each other?

However, both biddings are a vast chapter to discuss, so we have designed a different article for Pre-Bid to explain. Google’s Exchange Bidding in Dynamic Allocation (EBDA) is now known as Open Bidding. It’s a server-to-server unified auction mechanism.

Open Bidding permits you to welcome outsider demand partners to go after your ad inventory in a solitary auction with ongoing, server-to-server Bidding. Open Bidding in Google Ad Manager additionally gives trafficking, reporting, and billing.

How Open Bidding Works?

Open Bidding involves both major parties, Publishers and Advertisers, whenever an Ad request generates and passed on to the Ad manager, where Ad Manager runs a server-to-server auction and selects the best trafficked-line items to compete.

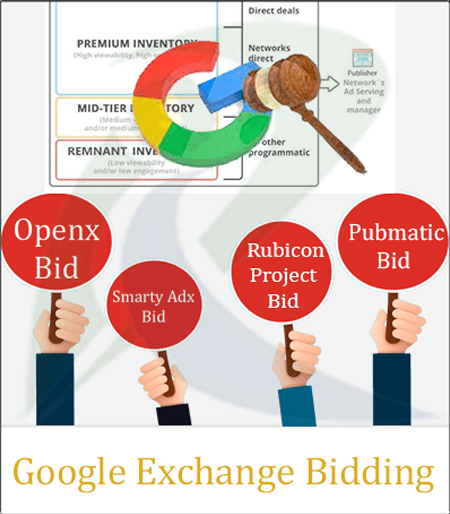

Ad Manager also sends an invitation to Adx and third-party exchanges, for instance, Pubmatic, Rubicon Project, Smarty Ads, OpenX, and many more. These exchange partners run their auction before heading toward the Ad Manager. Then Ad Manager Hosts a unified auction to select a winner.

After all this process Ad Manager gets back to the Publisher’s Ad inventory to place the winner’s ad over there.

Waterfall Management Before Google Open Bidding:

Before Open Bidding, it used to take place by waterfall setup:

Waterfall setup works this way: A stepping stool of networks, orchestrated from start to finish, arranged according to the publisher’s performance – in view of the networks’ previous record regarding yield (eCPM), fill rate, latency, and lots of other aspects.

The impression(s) passes from one network to another, starting from the top, until it is sales out.

This cycle diverts an impression from one SSP/exchange/network to the others until it is sold. This sale is daisy chaining. Indeed, waterfall and daisy-chaining are something similar.

This is called waterfall because the auction starts from high prices at the highest value Ad-inventories to the lowest cost at less value Ad-inventory.

What If More than One Yield Partner is Eligible?

Google exchange lists eligible yield partner groups and sends only one bid request via Ad manager. If yield partners get eligible in more than one group, only one bid request will be sent to the yield partner. And will bid again. It will certainly go for a second auction, and both eligible partners will no longer bid for the same inventory.

Benefits of Google Open Bidding:

Along with expanding yield, Open Bidding gives a few advantages of execution and activity.

Drastically Limited Latency:

Through a direct server-to-server association with third-party exchanges and all-inclusive auction sessions of 160ms (up from the Ad Exchange prerequisite of 100ms), Open Bidding diminishes latency (when contrasted with Pre-bid executions) for a more consistent client experience.

Simplified Operations:

Open Bidding disposes of the need to oversee complex custom Pre-bid code and the various Ad Manager details related to a Pre-bid execution. Qualified inventory trafficked in Ad Manager can profit by Open Bidding with no additional technical requirement.

Transparency:

Google Exchange provides complete information about how much you are earning. You can also get your payment in net 30 days. Not only this, it does not deduct any extra amount of 5% to 10% for discrepancies. That means it transparently serves, pays bills, and gives detailed reports under one single stack.

Better Analytics:

Unified reporting brings all the valuable information about advertisers and brands. It also facilitates publishers with sales channel reports that clarify the source of income.